Decoding Airline Ticket Pricing: A Case Study of Fluctuations and Savings

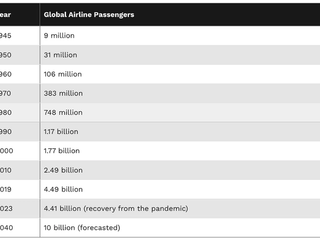

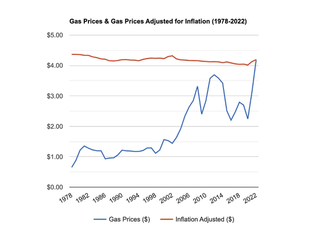

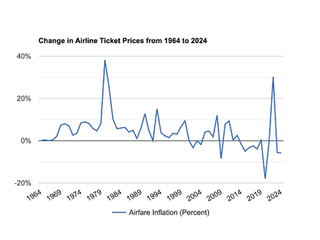

Airlines prices, as a whole, when factoring in inflation, have fallen since the 50’s. Since the 1978 deregulation, airlines have had more freedom and benefitted from lower overheads therefore able to operate at higher profit margins. These days, it’s a much different story with exponential growth volumes of air passengers, advancement in air travel technology, fewer stops, higher fuel prices and increased competition have all contributed to declining ticket prices (when factoring inflation).

Once upon a time, ticketing followed logical economics of supply and demand. Tickets were less expensive when purchased in advance and a reduction in empty seats (supply) produced increased prices. The modern day business traveler turned this around where tickets were purchased more sporadically and with different intent. More demand in later bookings skewing the airlines need to attract to a spontaneous passengers schedule.

Airline’s are notorious for volatile pricing and fare fluctuations on a weekly, daily or even hourly basis. This “dynamic pricing” model adds a veil of mystery about when a passenger should book their ticket to optimize the price. Travel agency sites such as Bookings.com, Expedia or Kayak have given the ability to cross reference multiple airline at any given minute allowing travelers to compare all available options. Sites, such as Hopper, began showing predictive pricing based on historical data to time the best purchasing day. Neither of these guarantee optimum results. Here is a case study that explains how pAiback adds further transparency to the ticket booking process for a frequent flier.

Mr. Cruise, a frequent flyer, booked a round-trip, first class ticket from JFK to CDG. Booking the date that best fit his plans, Mr. Cruise looked at which times were most ideal for flying. The flight DL1234, was 6,000 US dollars. Happy with his selection, he proceeded to purchase the ticket securing his travel plans.

As a registered customer at pAiback, Mr. Cruise was astonished to discover on his account dashboard that, shortly after booking, his ticket surged to a staggering 12,000 U.S. dollars. The chart almost seemed unreal and he was relieved that he purchased the ticket at the time that he did to avoid this astronomical spike. Now, Mr. Cruise became intrigued to watch the prices move, knowing that a fluctuation could happen again.

12 days later at 18:00, Mr. Cruise received the notification indicating that the fare dropped below his initial purchase price to 4500 U.S. dollars. Mr. Cruise was relieved to see that pAiback’s automated system immediately seized the difference after contacting the airline on his behalf. He was even more happy that he had a 1500 U.S. dollars e-credit against his initial purchase in his airline wallet.

Given Mr. Cruise's work schedule, he did not have an opportunity to read these emails until later in the day. By the time he had read the emails, the entire transaction had taken place and e-credits received into his account. Looking at his pAiback dashboard highlighted that the savings was an impressive 25%. Had he purchased three days later the drop would have been a staggering 7500 U.S. dollars or 63% less.

pAiback has the power to track any class of ticket securing the same flight, at the same time, in the same seat, at a reduced price. The pAiback system removes the impact of the volatility and complexity of airline ticket pricing. This shows the significant importance of pAiback, providing real time data for flights and savings. Understanding the dynamics at play and staying wise, pAiback can maximize savings and unlock the value in this unpredictable and shrouded market.